PLATFORM

LEARN MORE

transparency. smart growth. accountability.

-

I promise to continue to bring my background and experience as an analyst, helping leaders make mission critical decisions, to this position — to make decisions based on facts, not politics. I’ve done exactly that and some of what I’ve found is deeply alarming…

-

One of the more critical findings has been the redirecting of new housing property tax into residential TIF agreements to pay developer infrastructure costs. In some cases after payoff, what amounts to millions of dollars will be locked away for years or diverted from our schools for the next decade. Those redirected school funds will never be restored to the schools.Once that revenue is gone, it’s gone.

To assume new residents will offset this with income tax is short sighted—especially since what we collect only applies to income above other cities’ rates.

This isn’t sustainable. It’s risky.

-

If we don’t change course now, our city will be burdened for years with financial commitments that benefit developers first — not the people who live here. We need accountability, transparency, and leadership willing to say “enough” before it’s too late.

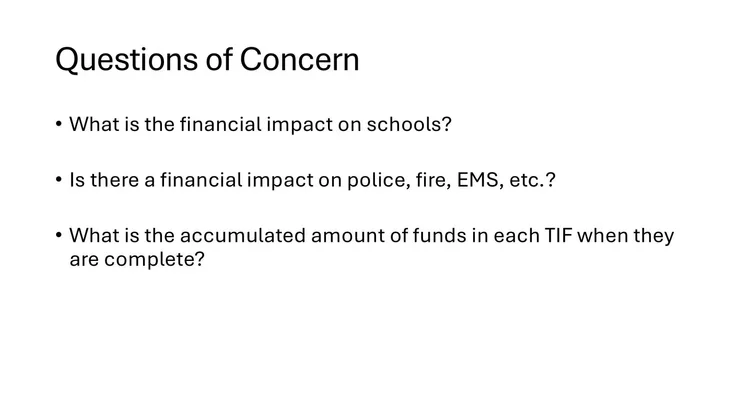

financial impacts of tifs on clayton residents

A TIF (Tax Increment Financing) diverts tax money from schools, police, fire, EMS, and other community services to fund local development projects. This means fewer resources for essential services while paying for roads, utilities, or new buildings in the TIF area.

what is a tif?

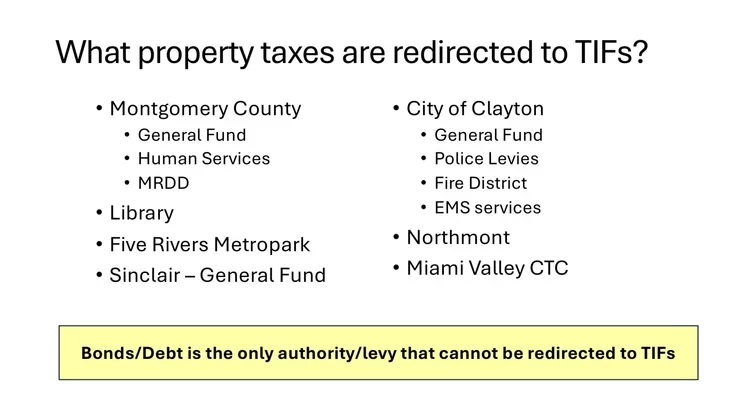

types of property taxes redirected to tifs:

Montgomery County

General Fund

Human Services

MRDD

Library

Five Rivers Metropark

Sinclair - General Fund

City of Clayton

General Fund

Police Levies

Fire District

EMS Services

Northmont

Miami Valley CTC

Bonds/Debt is the only authority/levy that cannot be redirected to TIFs

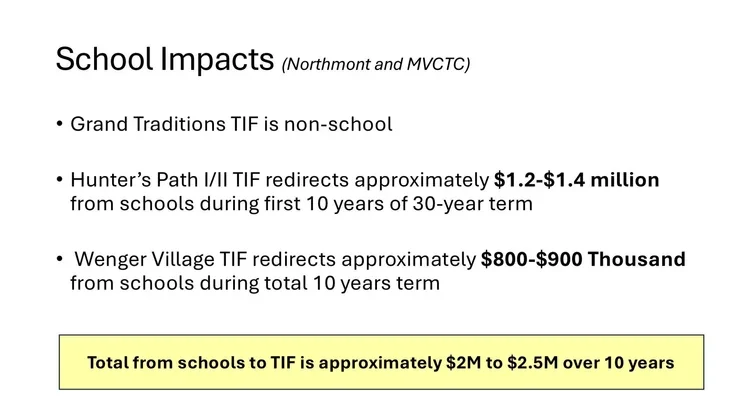

impact on our schools

The total amount of money redirected from schools to TIFs is approximately $2–2.5 million over 10 years.

Hunter's Path I/II TIF redirects approximately $1.2-$1.4 million from schools during first 10 years of 30-year term

Wenger Village TIF redirects approximately $800,000-$900,000 from schools during total 10 years term

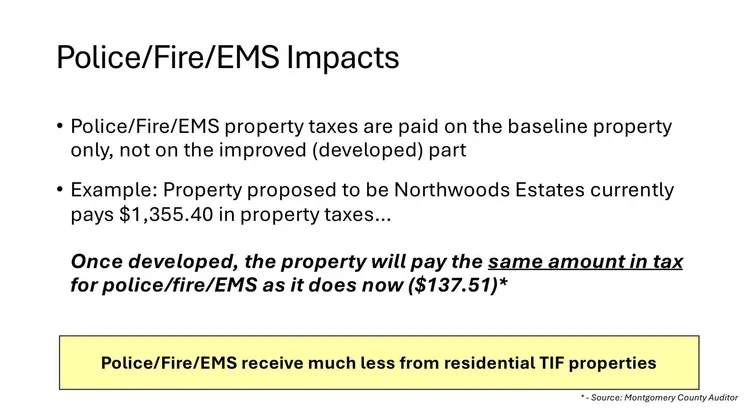

impact on police, fire, and EMS

Police/Fire/EMS receive much less from residential TIF properties

Police/Fire/EMS property taxes are paid on the baseline property only, not on the improved (developed) part

Example: Property proposed to be Northwoods Estates currently pays $1,355.40 in property taxes.

Once developed, the property will pay the same amount in tax for police/fire/EMS as it does now ($137.51)

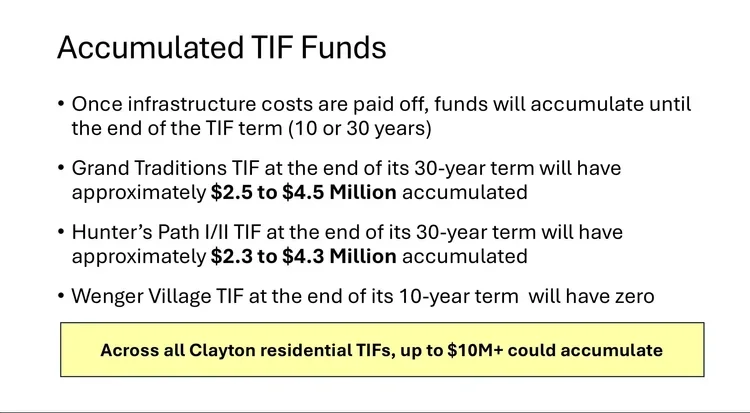

TIF Funds Can Accumulate But at What Cost?

Once development costs are covered, TIFs continue to hold millions in tax dollars for decades. This money doesn’t go back to schools, police, fire, or EMS until the term ends. Across Clayton, these accumulated TIF funds could total $10 million or more.

Grand Traditions TIF: $2.5–$4.5 million could accumulate over 30 years.

Hunter’s Path I/II TIF: $2.3–$4.3 million could accumulate over 30 years.

Every dollar tied up in TIFs is a dollar taxpayers are paying that won’t support the community they live in until the TIF finally ends.

$10 million or more could sit unused in tifs.

money that could have supported schools, emergency services, and neighborhoods.

accountability at work:

Residential TIF Presentation to Clayton Council

October 2, 2025

I recently made a presentation to Clayton Council on my findings exploring the mid- to far-term impacts of Residential TIFs on Clayton. The charts for the presentation can be found below the video.

To clarify a statement the attorney made regarding where funds go at the end of a TIF agreement, I verified the funds go to the city’s general fund, which was confirmed.

TO NOTE: When schools are “made whole”, that means they are restored to getting 100% of property tax funds due them after a TIF limitation (usually losing 75% due) has expired. This to many is a confusing term that may lead some to think schools will receive the funds lost after the TIF has expired, but that is not the case. “When it’s gone, it’s gone.”